When people talk about the energy transition, they mean replacing fossil fuels with renewables. The real shift is using less energy.

Daniel Yergin argues this isn’t a transition but an energy addition—renewables are stacking on top of still-growing fossil fuel use. Net zero isn’t happening.

“The energy transition is not just about energy; it is about rewiring and reengineering the entire global economy.”

Daniel Yergin, Peter Orszag, and Atul Arya, “The Troubled Energy Transition“

The first step is recognizing why the transition’s key assumptions failed. Past energy shifts—like wood to coal—meant better performance at lower cost. Renewables flip that script: less reliability, higher prices.

The Cost of a Fantasy

The price tag for net zero? $6.3–$6.7 trillion per year by 2030, climbing to $8 trillion by 2035. That’s 5% of global GDP annually through 2050. Nearly half of the bill falls on the Global South—where many countries are already drowning in debt.

Net zero isn’t just about cutting emissions. It requires a massive capital shift from the Global North to the South, funding renewables in economies that can barely stay afloat.

It’s time for some honesty: this isn’t happening. History and physics don’t support an energy transition. Whatever unfolds won’t satisfy its promoters—their expectations are pure fantasy. Reality—growth, security, geopolitics—won’t bow to green ideology.

We’re already seeing that in the abandonment of climate goals by governments around the world. Climate concerns are taking a backseat to tariffs, trade wars, inflation, and soaring energy costs. People want relief, not lofty climate goals. Immigration, crime, and populism dominate politics, while fractured coalitions and weak leadership make action even less likely.

Big Oil Knows the Score

Even oil companies that tried going green are running back to oil and gas. BP, the poster child for the transition, is now in turmoil—its stock plunge turned it into a target for Wall Street sharks. After years of chasing a future beyond petroleum, Big Oil is back to what actually makes money: fossil fuels.

“The Europeans learned the hard way that investors want to see their capital deployed in a disciplined manner — they want to see a rate of return on that capital.

“If you have to cut your dividend and share repurchases because of investments in renewables then you’re going to get a haircut in your valuation.”

Ben Cook, Hennessy Funds

The Coming Supply Plateau

Flat or declining oil production and consumption will reshape the global economy in ways Yergin and his colleagues overlooked in The Troubled Energy Transition.

Peak oil talk has shifted to peak demand, but the two are inseparable. Markets focus on supply because it responds to price—demand, not so much.

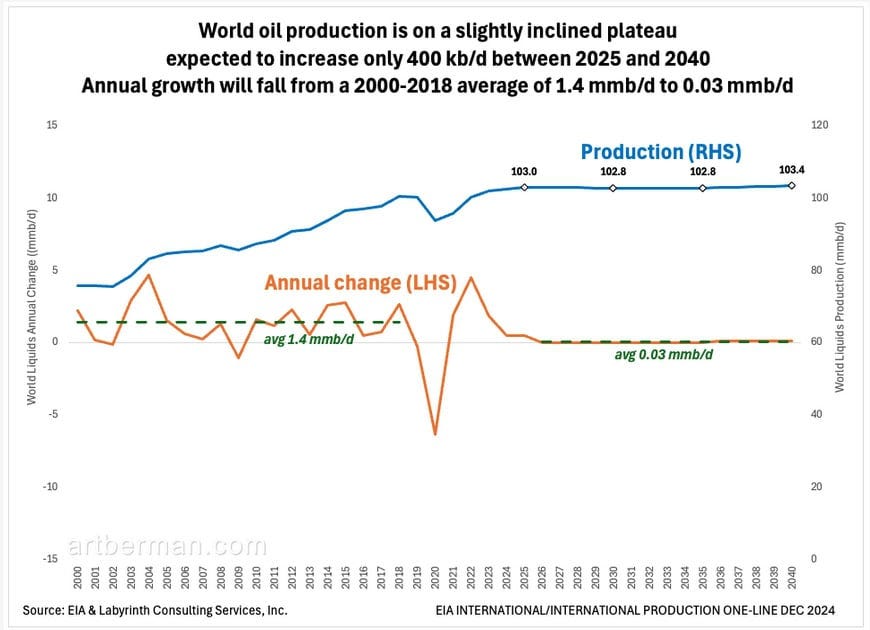

The U.S. Energy Information Administration projects global liquids production will rise just 400,000 bpd from 2025 to 2040 (Figure 1). Annual growth, once 1.4 million bpd, is set to collapse to near zero. The engine of global economic growth is stalling—starting now. Let that sink in.

The IEA is even more pessimistic, projecting a 6 million bpd drop by 2040 (Figure 2). Renewables can grow all they want—wind and solar won’t power steel, concrete, plastic, or fertilizer, let alone the global transport network that keeps trade and commerce running.